SUPPLIER SHORTAGES CAUSE AUTO PRODUCTION DISRUPTION

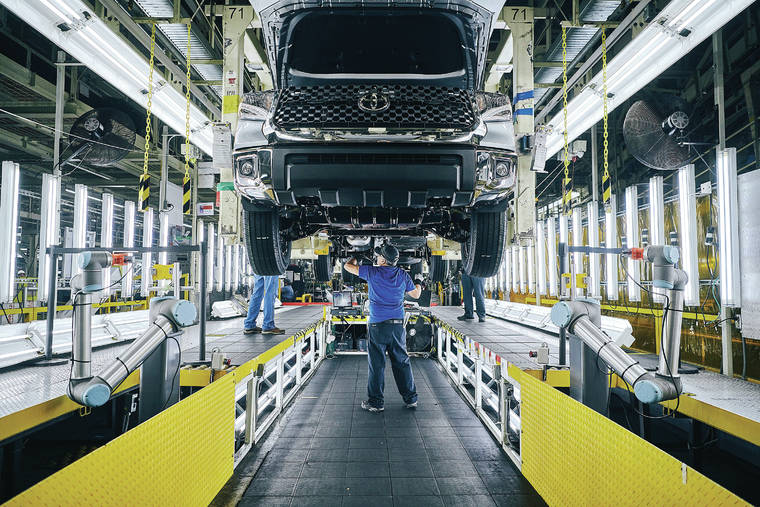

Employees work on the assembly lines at Toyota’s manufacturing plant in San Antonio, Texas in this file photo. Severe weather, port blockages and microchip shortages are wreaking havoc on U.S. auto production with Toyota Motor Corp. and Honda Motor Co. Ltd. now facing disruptions. (Toyota Texas/TNS)

Severe weather, port blockages and microchip shortages are wreaking havoc on U.S. auto production with Toyota Motor Corp. and Honda Motor Co. Ltd. now facing disruptions.

Severe weather, port blockages and microchip shortages are wreaking havoc on U.S. auto production with Toyota Motor Corp. and Honda Motor Co. Ltd. now facing disruptions.

The Japanese automakers said Wednesday they are halting production at plants in North America because of limits in needed supplies, including petrochemicals used in plastic and electronic components and semiconductors. They join other automakers like General Motors Co. that also have had to shut down plants this month because of the global shortage of microchips used for driver-assist features to heated seats as well as in consumer electronics.

The challenges, especially with semiconductors, highlight the need for strategic alignments for certain parts that require large amounts of scale and investment. That includes batteries needed for forthcoming electric vehicles.

“The scale of production is huge, the investment is huge, and the alignment is strategic,” Kristin Dziczek, vice president of industry, labor and economics at the Center for Automotive Research in Ann Arbor, said of both semiconductors and vehicle batteries. “Disruptions that happen there are going to be difficult to deal with. They do not flow as smoothly as other parts in the industry. It’s sticky and chunky.”

Toyota’s disruptions aren’t related to semiconductors, but to a shortage of petrochemicals resulting from extreme winter weather in Texas and Mexico earlier this month. It affects production of Camry and Avalon sedans and the hybrid RAV4 SUV in Kentucky, engines in West Virginia and Tacoma pickups in Mexico. It is unclear how long the disruption will last, but the automaker does not expect to furlough any employees.

That’s also the case for North American employees at Honda even though the company says all of its auto plants in the U.S. and Canada are being affected in some way. Production at most plants will be halted next week, though the situation remains fluid.

“We continue to manage a number of supply chain issues related to the impact from COVID-19, congestion at various ports, the microchip shortage and severe winter weather over the past several weeks,” Honda said in a statement.

Pandemic-induced restrictions at West Coast ports have become overwhelmed following the implementation of COVID-19 restrictions. Vancouver, Washington, had a record-breaking 2020 with revenues totaling $50 million, a 15% increase over 2019. February imports rose 26% year-over-year in Oakland, California, and 53% in Los Angeles.

“One year ago, global trade slowed to a crawl as the Covid-19 pandemic first hit China and then spread worldwide,” Gene Seroka, port of Los Angeles executive director, said this week in a statement. “Today, we are in the seventh month of an unparalleled import surge, driven by unprecedented demands by American consumers.”

Semiconductor manufacturers, meanwhile, last year had pivoted from producing microchips for automakers, who shut down North American production for weeks, to consumer electronics that experienced increasing demand as more people worked from home and students went to school online.

“It takes three to six months to reallocate,” Dziczek said. “It’s going to take several months to get that capacity needed after the automakers came back and consumer demand was strong.”

Because of semiconductor shortages, production also halted this week at GM’s Lansing Grand River making the Chevrolet Camaro and Cadillac CT4 and CT5. It will be down through the rest of March along with the San Luis Potosi plant in Mexico where the Chevrolet Equinox and Trax and GMC Terrain SUVs are built. Other plants facing extended downtown are in Kansas where the Cadillac XT4 SUV and Chevrolet Malibu are made and in Ontario where the Equinox is built. A plant in Brazil also is facing downtown in April and May. Last month, GM said the shortage could hurt 2021 earnings by $1.5 to $2 billion.

Subaru Corp. said it has cut back on overtime work and holiday shifts at its Indiana factory. U.S. plants operated by Ford Motor Co., Nissan Motor Co. Ltd. and Volkswagen AG are operating. Stellantis NV did not specify Wednesday if any plants remain down.

There often are strategic partnerships between automakers and manufacturers producing specialized microchips for their vehicles. Last year, for example, Daimler AG’s Mercedes-Benz announced a partnership to use software developed by microchip maker NVIDIA Corp. for automated driving functions.

That makes it difficult for automakers to trade out vendors — similar to the differences between Apple Inc.’s iPhone operating system and that of an Android mobile device, said Sam Abuelsamid, principal e-mobility analyst at Guidehouse Insights.

“You can’t directly run the software on one chip on the other chip,” Abuelsamid said. “To replace that, it requires a lot of the software that has to run on it to make it work. It can be done, but it takes a long time.”

And it’s expensive: Taiwan Semiconductor Manufacturing Co. last year announced a $12 billion factory in Arizona — roughly six times the costs for a new automotive assembly plant, Dziczek said.

Likewise, vehicle batteries are specialized, coming in different shapes and designs. Volkswagen this week announced it was switching to a unified prismatic battery for future electric vehicles. The decision led to a $14 billion order from Swedish battery maker Northvolt and moved it away from the pouch-style batteries made by LG Chem Ltd. and SK Innovation Co.

Honda has created an alliance to use GM’s Ultium battery technology it will manufacture with LG Chem. A $2.3 billion battery plant in northeast Ohio will have 30-gigawatt hours of capacity. Depending on the size of the vehicle, that may translate to 300,000 to 400,000 units. VW’s plans are even larger for plants with 40 gigawatt hours of capacity.

“Batteries are specialized, not interchangeable and there’s these strategic tie-ups and supplier relationships, while there aren’t very many independent battery plants,” Dzcizek said. “You have these big blocks coming online. That makes it stickier between companies. The case is the same with semiconductors.”