Panel discusses proposed property tax in advance of November vote

Community members attend Wednesday evening’s Community Forum on the property tax ballot initiative to fund education at the West Hawaii Civic Center. (Laura Ruminski/West Hawaii Today)

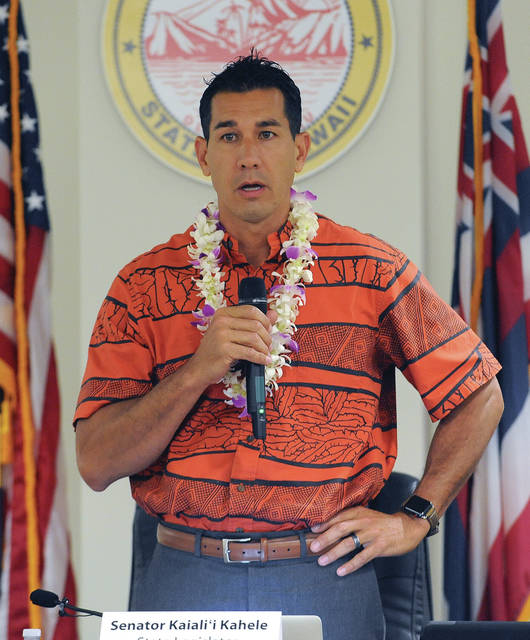

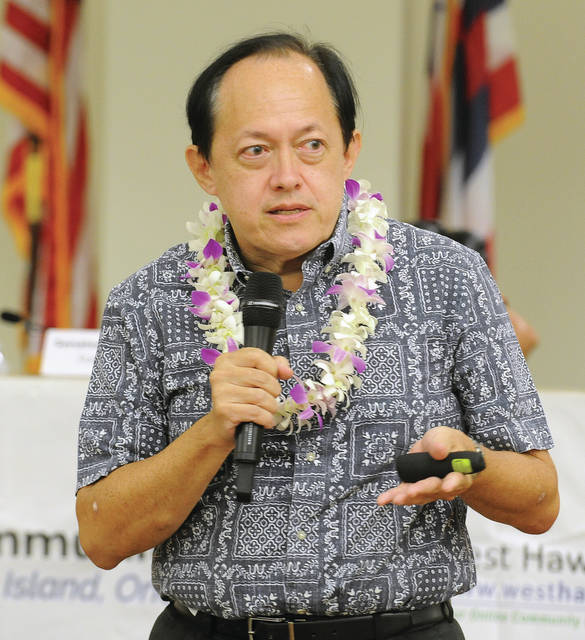

Community Forum panel members Corey Ronenlee, HSTA president, right; Tom Yamachika, Tax Foundation of Hawaii; Kaialii Kahele, state senator; Sherry Menor-McNamara, Chamber of Commerce Hawaii; and Lisa Miura, County of Hawaii Real Property Tax administrator express their views Wednesday at the West Hawaii Civic Center on the proposed property tax ballot initiative to fund education. (Laura Ruminski/West Hawaii Today)

KAILUA-KONA — While supporters of a proposed constitutional amendment say it could raise much-needed funds for the state’s public schools, opponents argue the proposal has too many ambiguities and too few guarantees.

KAILUA-KONA — While supporters of a proposed constitutional amendment say it could raise much-needed funds for the state’s public schools, opponents argue the proposal has too many ambiguities and too few guarantees.

The constitutional amendment, which will be on the November ballot, proposes allowing the Legislature to enact a surcharge on investment properties with the revenue to go toward public education.

It was also the topic of a community forum held Wednesday night at the West Hawaii Civic Center, bringing in about three dozen community members to hear public officials and state leaders make their case for or against the proposal and field questions before Hawaii heads to the polls on Nov. 6.

On the panel were Sen. Kaialii Kahele, D-Hilo; Sherry Menor-McNamara, president of Chamber of Commerce Hawaii; Corey Rosenlee, president of the Hawaii State Teachers Association; Lisa Miura, administrator of the Hawaii County Real Property Tax Division; and Tom Yamachika, president of the Tax Foundation of Hawaii. Moderator Sherry Bracken said an invitation had been extended to the Department of Education, although nobody from that agency participated in Wednesday’s panel.

The Department of Education gets about $2 billion in total funds, including those that come from the federal government, said Kahele, adding the department still needs between $250 million and $300 million.

And any more allocation from the general fund would have to come from cuts to somewhere else, unless the state brings more revenues in.

In Rosenlee’s opening remarks, the HSTA president laid out his arguments for supporting the proposal, starting with last week’s announcement from WalletHub identifying Hawaii as the worst state for teachers.

WalletHub based that ranking on metrics like pay, income growth potential, share of uncertified teachers and teacher turnover, among others.

Rosenlee said that each day, a third of the state’s students — about 60,000 children — go to school and don’t have a qualified teacher. The state is also short 300-500 special education teachers, he added.

“A ‘no’ vote means the status quo,” he said. “It will continue to make sure that our schools are underfunded and that we do not provide our teachers or our students the schools they deserve.”

But others on the panel spoke out about what was left out of the final version of the bill and ballot question— particularly when it comes to defining what would be subject to tax and precisely where the raised revenue would go.

“Proponents argue that it’s only meant for $1 million-plus non-occupied investment property,” said Menor-McNamara. “That’s not what the constitutional amendment states. Nowhere in that Con-Am does it specify the type and cost threshold of the property.”

The original text of the proposed amendment included in Senate Bill 2922 did specifically include “property valued at $1 million or greater” and excluded a homeowner’s primary residence. That bill also included a definition of “residential investment property.”

The bill also specified the revenue would go to educational uses, among them teacher retention and recruitment, public preschools, lower class sizes and special education programs.

The final version of the ballot question didn’t set a value threshold and only specified the revenue “shall be used to support public education.” The final text of the bill also didn’t include a definition of “real investment property.”

Those specifics were removed when the House made its changes to the Senate bill — changes Kahele said he disagreed with.

“I would have much rather had the Senate version of the bill,” he said — to which Rosenlee replied, “Me too.”

Kahele said he wants to see specific investments in preschools throughout the state, special education and capital improvement projects at schools.

“That’s what the money should go for,” he said. “It shouldn’t go for administrative salaries or waste, fraud and abuse. It should go specifically for certain categories.”

Rosenlee said a “yes” vote in November keeps the dialogue about education going.

“I’m afraid that if we vote ‘no,’ what’s going to happen is the conversation stops,” he said. “If we say ‘yes,’ what it does is we can go into the Legislature with exactly the things that many of us agree upon.”

But not having those guarantees inked into the ballot question leaves in too much uncertainty, others argued. And some on the panel pointed to history as their guide as to where giving the Legislature a new tax power could lead.

Miura, speaking about the impact the amendment could have on the counties, referenced the cap placed on the counties’ share of revenues collected through the transient accommodations tax, or TAT.

“If we got what we were supposed to get from the TAT, we would be getting $41 million to this county right now,” she said. “We get $19 million.”

She also raised the issue of supplanting or using revenue collected through the surcharge to replace, rather than supplement, existing appropriations to the Department of Education. That would effectively result in no net gain in funds for public schools.

Rosenlee said that, too, is another thing they want to see addressed so education funds aren’t supplanted.

If the constitutional amendment passes, Kahele said he expects both the Senate and the House would begin drafting legislation. Those bills would follow the standard legislative process, he said, adding there was “no question” it would go through the Senate Committee on Ways and Means, which oversees issues including taxes and other revenues.

Honolulu will tax the Big Island then give us part of the money back? This will be an education alright and the lesson is.. “some people never learn”.

I assume Hawaii has public schools & teachers, so yes, a considerable sum will go back to each county because teachers & achools spending money stimulates the economy.

Cool I am going to Honolulu for the weekend so tell you what.. you give me a $100 and I will bring you back what is left after I pay the additional Transient Accommodation Taxes to fund the rail. Don’t worry, there should be at least $20 left of the $100. Later on we can discuss you giving me another $10 since by giving you your own money back it will create economic activity and I of course want my share 🙂

The Honolulu rail costs more than a billion Dollar a mile, they should have hired a Chinese construction company they do it for much less and they finish on time.

What this comes down to is representatives have run out of options to increase taxes on state voters without affecting their ability to retain power. They also have their union special interests to pay off in order to keep them voting. Now they are putting forth a scheme to imply they will only tax, non resident, non voting people, an implied “win win” for everyone without even considering all factors. Eventually they will raise taxes on everyone and their union friends will laugh all the way to the bank.

Why not put forth an amendment to forbid public employee wages increases when money is not there? Why not an amendment to not spend 10 BILLION dollars on a train that only applies to a very small population?

VOTE NO!

…in a public office you don’t have to prove your expertise. This is even worse.

Taxation is theft.

Fine. Go live in the wilderness without any services.

We pay thru the ASS now and get nothing!

What services do you get? America gives 158 billion a year to Israel in direct/indirect help. Moreover key industries have been moved to Tel Aviv. Israel sells US defense technology to India and China – China sells it to other countries. Laughable.

Let the Education Administrators work out the problems and solutions.

The value of a constitutional amendment is divided by factions.

Choosing now appears wasteful and non productive.

I am voting NO, perhaps we should see budget responsibility first then we can talk about new taxes!

Lets raise the taxes but not the income situation. Great!

The mentality of the political culture in Hawaii is a lot like hell, it never has enough!