A new law addressing taxes and regulations on vape products, e-cigarettes and electronic smoking devices went into effect for Hawaii on Saturday.

The law bans the shipment of vaping products and e-cigarettes to anyone on the islands without a proper license and will require retailers and wholesalers to update their permits and licensing with the Department of Taxation.

Prior to the law, Hawaii did not regulate electronic smoking devices through licensing, permitting or taxation, but beginning Jan. 1 2024, e-cigarettes and vape products will be taxed at the same rate as other tobacco products.

The change will result in a 70% cost increase for retailers seeking proper permits and licensing. As a result, the cost of vaping products sold throughout the state could increase to offset the new fees.

“Any time you have more clear restrictions with licensing and permitting, and you’re able to hold the retailer accountable for whom they sell to, you are going to have an impact on who’s buying,” said Peggy Mierzwa, director of policy and advocacy at Hawaii Public Health Institute. “Any time something goes up in price, it particularly hurts young buyers, they’re price conscious purchasers.”

The state Department of Health reported that nearly 1 in 3 Hawaii high school students vape regularly, and for Hawaii County, more than 1 in 10 middle schoolers have tried vaping, the highest of any county throughout the state.

“Kids will no longer be able to purchase online and just say they’re 21 and get it delivered to their home,” Mierzwa added. “We’re also going to have a better sense of what’s coming into the state now and there will be more responsibility all around.”

But the change in permitting and licensing, along with the new costs, has concerned groups like the Retail Merchants of Hawaii, a nonprofit trade organization representing a variety of mom and pop stores, large box stores and other retailers throughout the state.

“The assumption is that if electronic smoking products are too expensive, less people will purchase them, this is not the case,” said Retail Merchants of Hawaii President Tina Yamaki in written testimony opposing the bill. “We will see more people finding ways to purchase from military facilities where there are no taxes charged, furthermore, this pushes vape products to be even more desirable on the black market where prices are lower.”

Yamaki added the change may also inadvertently impact a consumer’s decision on what to purchase.

“If raising the taxes is meant to deter people from smoking or vaping, it may have the opposite effect, and have them turn back to cigarettes,” Yamaki said.

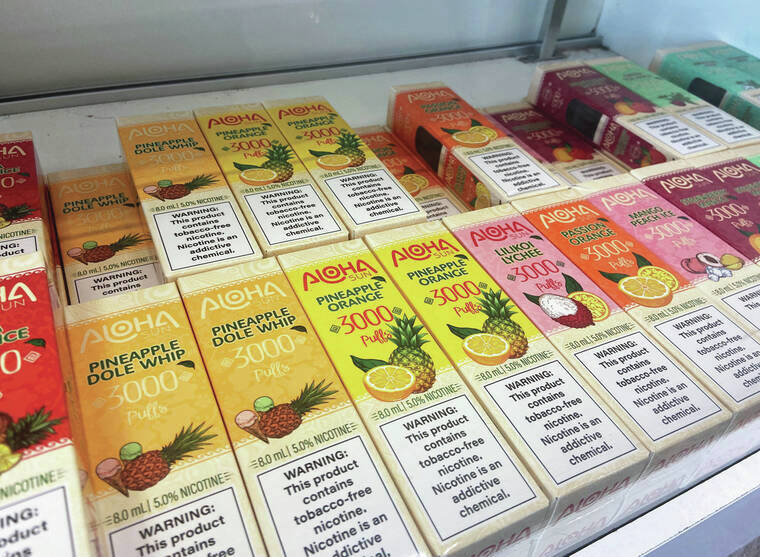

Several other vaping and tobacco-related bills were discussed this legislative session, but did not pass. This included a flavored tobacco ban as well as a generational ban on all tobacco products.

Some advocates are hopeful that the new laws will pave the way for additional legislation in future sessions.

“It’s sort of the same road we’ve seen with cigarettes, first they were regulated and then slowly we saw other things come into play about the age to buy and flavors,” Mierzwa said. “This is just a piece, but I do think it’s going to have a positive impact.”

Email Grant Phillips at gphillips@hawaiitribune-herald.com