Sometimes we wonder just how lucky we are to live in Hawaii.

We all know it’s a pricey place, but sometimes it takes raw statistics to drive that point home.

This week, we are looking at statistics from doxo, a bill payment network that boasts that they have seven million subscribers throughout the United States covering 97% of U.S. zip codes, and dealing with 120,000 unique billers.

In a recently released report, the company followed the 10 most common household bills, which account for $4.6 trillion in economic activity annually. These include mortgage; rent; auto loan; utilities (electric, gas, water & sewer, and waste & recycling); auto insurance; cable, internet & phone; health insurance; mobile phone; alarm & security; and life insurance.

According to the report, the average U.S. household spends $2,003 monthly and $24,032 a year on these bills. The biggest ones are mortgage, which 40% of households are paying at a cost of $547 monthly; rent, 35% of households at $395; auto loan, 73% of households at $316; utilities, 78% of households at $256; and auto insurance, 82% of households at $161. These bills cover on average 22% of U.S. household spending.

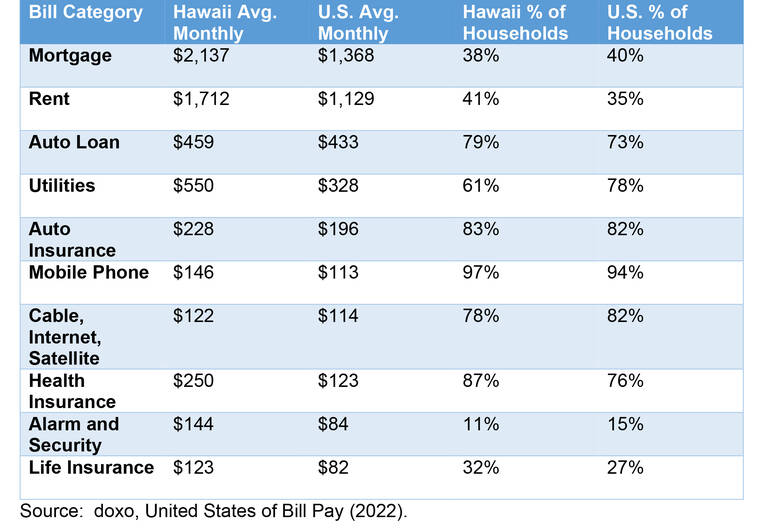

In this study, Hawaii wins first prize, and by a wide margin. Average bill costs in Hawaii are $2,911 per month, 45% above the national average, taking up a whopping 44% of household income. See the chart for how the different categories of bills shake out as compared with the national average:

The primary drivers in the table are rent, mortgage, and utilities. Mortgage and rent are 56% and 52% higher, which is to be expected given property values on an island, but utilities are 68% higher, which seems unexpectedly steep. One idea that comes to mind is that utilities are monopolies that are regulated by the government.

Health insurance here is fully double the national average, yet the medical professionals here are in short supply and they say they aren’t getting a chance to make ends meet. Perhaps some of the economic dynamics here are suspicious as well.

In some of the categories, we aren’t grotesquely above the national average, such as auto loan (6% more) and cable/Internet/satellite (7% more). What is it about those industries that make them more competitive while others such as alarm and security (71% more) and life insurance (50% more) seem to be more out of control?

Tom Yamachika is president of the Tax Foundation of Hawaii.