As the county continues pushing federal coronavirus relief money out to the public, there are still plenty of opportunities for individuals, businesses and nonprofits to apply for help with bills, rent, mortgages and utilities.

The county has until Dec. 30 to spend $80 million in federal grants or lose the money.

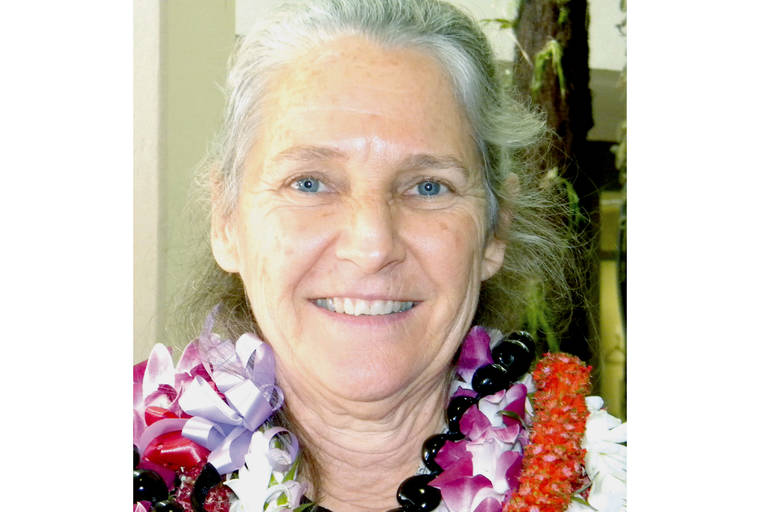

“We encourage people not to disqualify themselves. This is our opportunity to take this safety net and really help our families, our businesses and our communities,” county Research and Development Director Diane Ley said Thursday. “We don’t know what January will bring and we know people are hurting now.”

For example, individuals who’ve lost income due to COVID-19 can apply for up to $2,000 monthly in rent or mortgage assistance and $500 monthly for electric and gas bills.

Hawaii residents 18 years or older with an annual household income at or below 140% of area median income who suffered lost or reduced income due to the coronavirus pandemic can qualify for the rent or mortgage assistance. To meet income qualifications, a single-person household must have a maximum household income of $81,760. That rises to $93,380 for a two-person household, $116,620 for four people and on up to $154,000 for an eight-person household.

The county has allotted $8.5 million for the housing program and so far, through its community partners, has disbursed $1.2m to 338 households.

Small businesses and nonprofits, of 50 or fewer employees, that have a Hawaii Island location and were registered with the state prior to March 23 and suffered business interruptions can apply for one-time reimbursement of business expenses of up to $10,000.

Eligible expenses range from payroll to normal business costs such as rent, utilities and insurance, as well as costs incurred to meet government requirements of social distancing and employee/customer safety such as provision of hand sanitizers, disinfecting, installation of barriers/protection devices, signs and electronic/automation equipment.

Even businesses that received Payroll Protection Program or Small Business Administration loans can apply for funds, as long as they’re not for the same expenses covered by PPP or SBA loans, Ley said.

“When we look at our businesses, it’s really frustrating for them and a heartbreak for them put their hearts and souls into their businesses,” Ley said. “They’ve been tough, resilient and creative, but we really need to retain those businesses we can and help them succeed.”

Ley said the county has received 1,244 applications from the 22,000 businesses registered on the island.

As of Monday, the county, through its participating credit unions, has spent about $8 million of the $22 million allocated for this program, she said. Another $2.5 million is pending, she said.

The money comes from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act. Interested individuals, nonprofits and businesses can find out more about the programs and how to apply at www.hawaiicounty.gov/CARES.