WASHINGTON — Home sales are booming. Stocks are setting record highs. Industrial production is clambering out of the ditch it fell into early this year.

And yet the U.S. economy is nowhere close to regaining the health it achieved, with low unemployment, free-spending consumers and booming travel, before the coronavirus paralyzed the country in March. Not while the viral outbreak still rages and Congress remains deadlocked over providing more relief to tens of millions of people thrown out of work and to state and local governments whose revenue has withered.

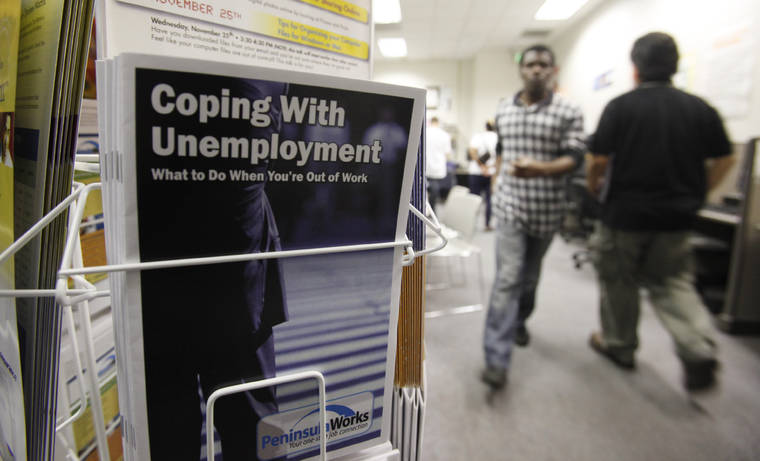

Every week, roughly 1 million new Americans are applying for unemployment benefits — a depth of job insecurity not seen in any single week during the depths of the 2007-2009 Great Recession.

Economists say that as many businesses have reopened and consumers have begun shopping and spending more, the picture is beginning to brighten, if only fitfully. Most say the economy is growing again. Yet scars are sure to remain from the catastrophic April-June quarter, when, according to the government, the economy collapsed at a 31.7% annual rate — by far the worst quarterly contraction since such record-keeping began in 1947.

Some industries, notably those involving travel and hotels and restaurants, could struggle for years. And while the number of confirmed viral infections has been declining, the threat of a major resurgence remains, especially as students increasingly return to schools and colleges. The consumers whose spending drives the bulk of the economy and the economists who analyze it are decidedly downbeat about the prospects for a return to prosperity.

“As long as we continue to see infection flare-ups, disruptions to activity — especially in sectors that are exposed to social distancing rules — will be ongoing,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. “The risk of business failures from repeated closures is high, and the probability of permanent job losses rises with each successive shutdown which could result in permanent damage to the labor market and the economy.”

The Conference Board, a business research group, reported this week that consumer confidence has tumbled to its lowest level since 2014.

And in survey results released this week by the National Association for Business Economics, two-thirds of the economists who were polled said they thought the U.S. economy remains in recession. Nearly half said they didn’t expect it to return to pre-pandemic levels until mid-2022. Eighty percent put the likelihood that any recovery will give way to a “double-dip” recession at 25% or more.

Early this spring, the economy went into free-fall as millions of businesses suddenly closed and consumers stayed home to avoid infection. Employers slashed more than 22 million jobs — a record total, by far — in March and April.

Since then, the job market and the economy have been rebounding as businesses slowly reopened. Efforts by the Federal Reserve to keep interest rates ultra-low have helped fuel a record-busting binge in the stock market. Home sales have surged, thanks to super-low mortgage rates and pent-up demand. And a resurgence in auto production has lifted American industry.

Altogether, employers added nearly 9.3 million jobs in May, June and July. Still, that hiring surge has replaced just 42% of the jobs lost in March and April. More than 27 million people are still receiving some form of unemployment aid.

Moreover, a summertime resurgence of confirmed COVID cases in the South and West forced many businesses to close again in July. The data firm Womply reports that business closures have mostly stabilized in the past four weeks. Still, 70% of Texas bars and 71% of California health and beauty shops were closed as of mid-August, Womply found.

After enacting a massive financial rescue package in March, congressional Republicans and Democrats have failed to agree on allocating more aid to the unemployed and to struggling states and localities. The expiration of a $600-a-week federal unemployment benefit — a lifeline to help the jobless survive the crisis — is leaving many families desperate.

“My income is basically cut in half,” said Taylor Love, a 34-year-old unemployed massage therapist in Austin, Texas. “Paying our mortgage is going to be a struggle. We’re going to have to dip into what little savings we have.”

President Donald Trump signed an executive order Aug. 8 offering a stripped-down version of the expanded unemployment benefits. At least 39 states have accepted or said that they would apply for federal grants that let them increase weekly benefits by $300 or $400. But questions remain about how soon that money will actually get to people or how long it will last.

In a question-and-answer session after a speech Thursday, Fed Chair Jerome Powell said that “if we can keep the disease under control, the economy can improve fairly quickly.” But he cautioned that sectors of the economy that have been hardest hit, notably travel and tourism, will take longer to recover.

“That is a lot of workers — we need to support them,” Powell said.

James Marple, senior economist at TD Economics, said he expects GDP growth to snap back from the second-quarter disaster. But in a research note Thursday, he cautioned that “this will not be enough to make the economy whole, and it will likely be well into 2021 and quite possibly later before the level of economic activity recaptures its pre-crisis level.

“Much will depend,” Marple said, “on the speed and effectiveness of a vaccine as well as the continuation of fiscal supports to bridge incomes until activity can return to normal.”

AP Economics Writer Martin Crutsinger contributed to this report.