US unemployment surges to a Depression-era level of 14.7%

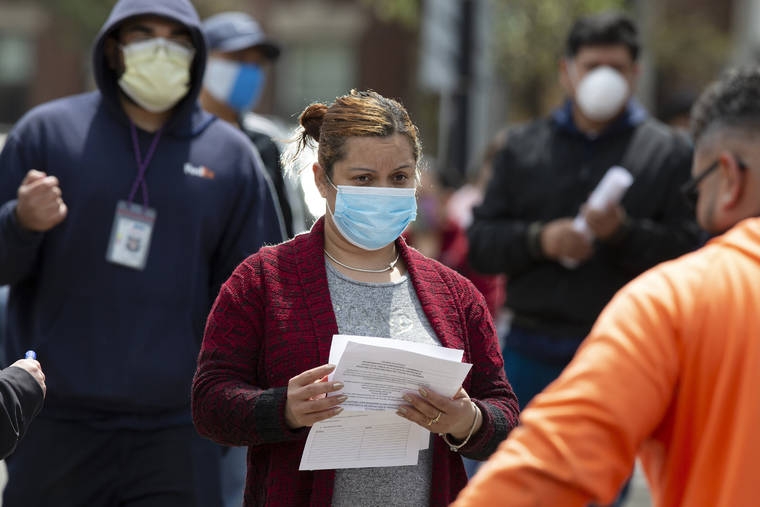

A woman waits to receive food at a distribution site during the coronavirus pandemic, Friday, May 8, 2020, in Chelsea, Mass. (AP Photo/Michael Dwyer)

FILE - In this May 7, 2020, file photo, a pedestrian walks by The Framing Gallery, closed due to the COVID-19 pandemic, in Grosse Pointe, Mich. The U.S. unemployment rate hit 14.7% in April, the highest rate since the Great Depression, as 20.5 million jobs vanished in the worst monthly loss on record. The figures are stark evidence of the damage the coronavirus has done to a now-shattered economy. (AP Photo/Paul Sancya, File)

WASHINGTON — The coronavirus crisis has sent the U.S. unemployment rate surging to 14.7%, a level last seen when the country was in the throes of the Depression and President Franklin D. Roosevelt was assuring Americans that the only thing to fear was fear itself.

WASHINGTON — The coronavirus crisis has sent the U.S. unemployment rate surging to 14.7%, a level last seen when the country was in the throes of the Depression and President Franklin D. Roosevelt was assuring Americans that the only thing to fear was fear itself.

The Labor Department said Friday that 20.5 million jobs vanished in April in the worst monthly loss on record, triggered by the coast-to-coast shutdowns of factories, stores, offices and other businesses. Unemployment is now at its highest point since 1939.

And because of government errors and the particular way it measures the job market, the true picture is even worse than the numbers suggest.

The breathtakingly swift losses are certain to intensify the push-pull across the U.S. over how and when to ease the stay-at-home restrictions and the social-distancing rules. And they rob President Donald Trump of the ability to point to a strong economy as he runs for reelection.

“The jobs report from hell is here,” said Sal Guatieri, senior economist at BMO Capital Markets, “one never seen before and unlikely to be seen again barring another pandemic or meteor hitting the earth.”

Stocks rallied on Wall Street in the morning when it turned out the report wasn’t quite as horrific as economists had forecast. The Dow Jones Industrial Average gained more than 300 points, or 1.3%.

Worldwide, the virus has infected at least 3.9 million people and killed over 270,000, including more than 76,000 in the U.S., according to a tally by Johns Hopkins University based on official data.

The unemployment report indicated that the vast majority of April’s job losses — roughly 75% — are considered temporary, a result of businesses that were forced to suddenly close but hope to reopen and recall their laid-off workers.

Whether most of those workers can return anytime soon, though, will be determined by how well policymakers, businesses and the public manage their response to the health crisis. And economists worry it will take years to recover all the jobs lost.

The collapse has occurred with stunning speed. In February, the unemployment rate was at a more than 50-year low of 3.5%, and employers had added jobs for a record 9 1/2 years. In March, unemployment was just 4.4%.

“In just two months the unemployment rate has gone from the lowest rate in 50 years to the highest rate in almost 90 years,” said Gus Faucher, chief economist at PNC Financial.

Nearly all the job growth achieved during the 11-year recovery from the financial meltdown has now been lost in one month.

The last time unemployment was this high was at the tail end of the Depression, before the U.S. entered World War II. Unemployment peaked at 25% during the decade-long slump.

Hai Nguyen, whose pet grooming business in Louisville, Kentucky, has been shut down since mid-March, has applied for a government small-business loan to no avail, missed rent payments, let go employees, filed for unemployment and racked up credit card debt to pay the bills.

He was allowed to reopen Monday but said the business is “going to be hurting.”

“Another month and it’ll be, like, chaos,” he said.

As bad as the numbers are, they don’t capture the full magnitude of the devastation.

The Labor Department said its survey-takers erroneously classified millions of Americans as employed in April even though their employers had closed down. If they had been counted correctly, the unemployment rate would have been nearly 20%, the government said.

Also, people who are out of work but aren’t actually looking for a new job are not officially counted as unemployed. An estimated 6.4 million people lost jobs last month but did not search for new ones, most likely because they saw little prospect of finding work with the economy shut down.

Counting them as unemployed would push the rate up further, to 24%, according to calculations by Heidi Shierholz, an economist at the Economic Policy Institute.

Trump, who faces the prospect of high unemployment rates through the November elections, said the figures were “no surprise.”

“What I can do is I’ll bring it back,” he said. “Those jobs will all be back, and they’ll be back very soon. And next year we’ll have a phenomenal year.”

However, the nonpartisan Congressional Budget Office has projected that the jobless rate will still be 9.5% by the end of 2021.

Though some businesses are beginning to reopen in certain states, factories, hotels, restaurants, resorts, sporting venues, movie theaters and many small businesses are still largely shuttered.

The government is dispensing nearly $3 trillion to help households and businesses pull through, including $1,200-per-person relief checks and an extra $600 in weekly unemployment benefits.

Trump has pushed aggressively to get businesses up and running again amid warnings from health experts that easing up too soon could lead to a deadly second wave of infections. As Election Day nears, the president will be judged by how he handles not just the economic crisis but the health one.

Just months ago, the Trump campaign planned to hammer its Democratic opponent this spring with negative ads while touting the strong economy. But since the outbreak, the re-election team has grown increasingly worried about the president’s standing in key states such as Michigan, Wisconsin and Florida. More than one-fifth of Michigan’s workers are on unemployment.

Former Vice President Joe Biden, meanwhile, has seized on the crisis as part of his overall attempt to cast Trump as caring only about the wealthiest Americans.

The health scourge has taken such a heavy economic toll around the world that economists have had to break out the history books.

This week, the Bank of England projected that Britain will see its biggest annual economic decline since 1706, when the European powers were embroiled in the War of the Spanish Succession.

Unemployment in the 19-country eurozone is expected to surpass 10% in coming months as more people are laid off. That figure is expected to remain lower than the U.S. unemployment rate, in part because millions of workers in places such as France and Germany are staying on the payrolls with the help of government aid that covers a large portion of their salaries.

Over the past seven weeks, an estimated 33.5 million American workers have filed for unemployment benefits. Friday’s job report is a different figure: It captures just five weeks, it is based on a mid-April survey of businesses and households, and it is a net figure — that is, it takes into account the hiring that some companies, such as Amazon and many grocery stores, have done.

Applications for unemployment benefits, while high, have declined for five straight weeks, a sign that the worst of the layoffs has passed. But few economists expect a rapid turnaround.

Harvard economist Raj Chetty said the economy’s health will hinge on when the outbreak has subsided enough that most Americans will feel comfortable returning to restaurants, bars, movie theaters and shops.

Small businesses are hanging on in hopes that spending and the economy will rebound soon, he said, but “there’s only so long you can hold out.”

Minorities and poor people have suffered the most from the economic shutdown. Job losses were especially severe among Latinos, whose unemployment rate leaped to 18.9% from 6% in March. The African-American rate jumped to 16.7%, while for whites it rose to 14.2%.

Almost half the 14 million U.S. hotel and restaurant workers lost their jobs last month. But losses have spread to nearly every industry, with even health care shedding 1.4 million jobs, nearly all of them from doctors’ and dentists’ offices, as Americans have cut back on all but necessary visits.

In addition to the millions of newly unemployed, 5.1 million others had their hours reduced in April.

___

AP Writer Jonathan Lemire and AP video journalist Jeff Roberson contributed to this story.