Hawaii County’s reliance on property taxes for its operations buffers it, at least in the short term, from the drastic tax losses experienced at the state level as it struggles to revive an economy clobbered by the coronavirus, local officials said Friday.

Still, said Finance Director Deanna Sako and Council Chairman Aaron Chung, it’s too early to tell what the budget hit could be from cuts in the general excise tax and fuel taxes, and the possible cutbacks in transient accommodations taxes the state shares with the counties.

“We’re all trying to look into our magic crystal ball,” Sako said. “We’re trying to do our best to estimate it and there are still a lot of unknowns.”

The County Council is scheduled at 9 a.m. Wednesday to hear from Ross Birch, executive director of the Island of Hawaii Visitors Bureau, on economic recovery efforts.

Chung, who had been calling for a hiring freeze, said Friday he’s more interested at this time that no new positions are created, at least until the county has a better grasp of the economic outlook. Employee pay and benefits accounts for more than 65% of the county budget.

“It’s not the time to be creating new positions, that’s clear. We should be proceeding with an eye toward austerity,” Chung said. “But we have to look at everything on a case-by-case basis. I would like to see us exercise some restraint in hiring. If the only way to exercise restraint is by cutting unfunded positions, so be it.”

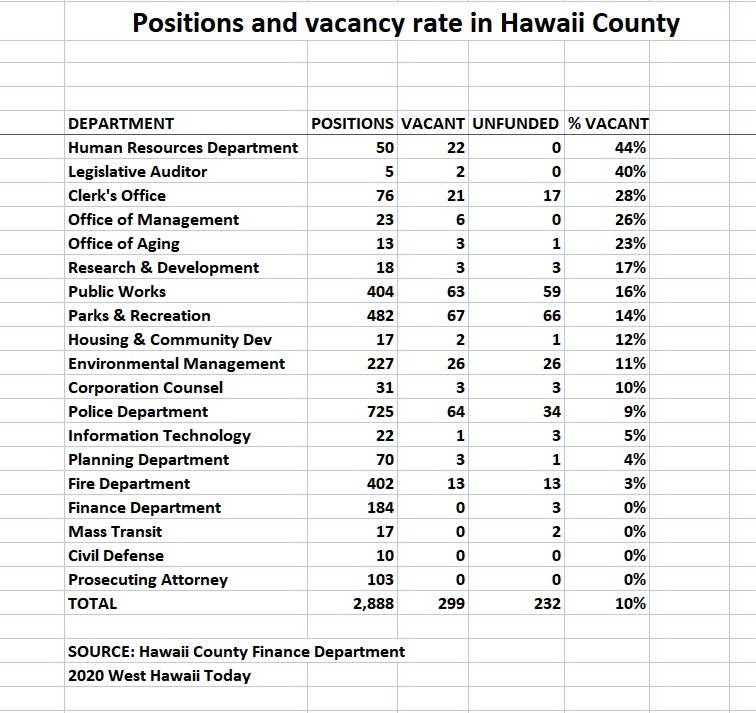

About 10% of the county’s 2,888 positions are currently vacant and have been unfunded in the budget, according to a West Hawaii Today analysis of position documents provided by the Finance Department as of Feb. 28. That ranges from fully staffed departments for the Finance Department, Mass Transit, Civil Defense and the Prosecuting Attorney’s Office to a 44% vacancy rate in the Department of Human Resources.

Property taxes, originally projected to be $343.5 million next year, accounts for the bulk of Mayor Harry Kim’s proposed $625.9 million operating budget, released Feb. 29. He’s scheduled to release an adjusted proposed budget May 5.

Currently, property owners face a 3.9% increase in property taxes based on an increase in property values with no additional taxes levied. The council has until June 19 to adopt property tax rates, and it’s unknown if there will be a move to increase or decrease them.

The county’s one-half cent GET surcharge was expected to bring in $50 million, while the fuel tax would have garnered $22.4 million, under the mayor’s proposed budget. Those revenues can be used only on roads, the Hele-On bus system and other transportation projects. The $25 million projected for licenses and permits is also likely to drop.

Hawaii County’s share of the TAT, collected on hotel rooms and short-term rentals, is currently $19 million. But the Legislature could trim that if the state needs the money.

“We’re going to have a better handle on what our revenue stream is going to look like,” Chung said. “At the same time, we have to expect some kind of shortfall. We have to anticipate the worst.”