HILO — Mayor Harry Kim wants more flexibility so he can stretch the general excise tax farther across the county budget. And, so far, the state Legislature is going along.

But that consent is by no means a given, with three of the Big Island’s seven state representatives recently voting with reservations and a fourth voting no on HB 1394, the House version of the flexibility bill. All four of the island’s state senators voted yes on the Senate version of the bill, SB 1428.

The bills would allow counties under 500,000 in population to use the GET proceeds for public safety and infrastructure, in addition to its currently allowed uses of transportation, mass transit and bikeways and trails.

The bills have crossed over for another round of votes, leaving county leaders hopeful the forward progress will continue, despite the local opposition.

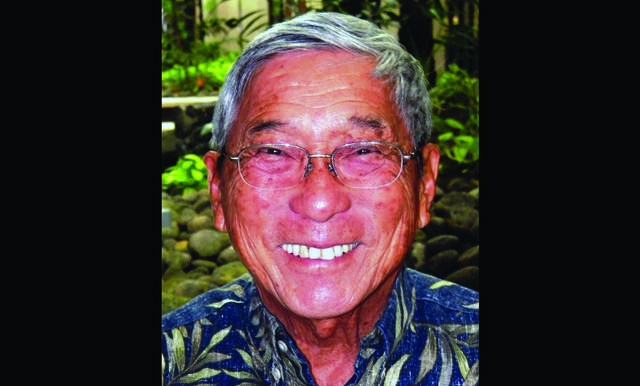

“We’ve tried. We told them our priority would still be roads,” Kim said Monday. “I’m concerned about it. Some of our own delegation have said no, but I’m still hopeful they will vote for it.”

A $60 million lava relief package has been the first priority for the council, said Council Chairman Aaron Chung, who represents Hilo. He said council lobbying efforts have focused on that, but the GET flexibility is also important. Chung said he’s flying to Honolulu today to discuss the matter with Senate President Ron Kouchi.

“The whole idea behind the GET, it enables us to diversify our revenue stream and not be so dependent on real property taxes,” Chung said. “Real property taxes have a huge trickle down effect on our local community.”

Several Big Island lawmakers say the county needs to catch up on roads and the public Hele-On bus system before it spends the money elsewhere. The county surcharge on the state tax was given to the counties in conjunction with allowing it for Honolulu, which needed money to pay for construction of its $9.2 billion rail project.

Rep. Joy San Buenaventura, D-Puna, was the Big Island’s no vote. She said the 2018 disasters have wreaked havoc on roads, especially in her district, and roads need to be rebuilt over the lava flow so her constituents can go home.

“I’m concerned that if we allow the county to use the GE tax extension for other purposes we will continue to have poor mass transit and poor road maintenance,” San Buenaventura said.

Rep. Nicole Lowen, D-Kona, one of the lawmakers voting yes with reservations, agreed there’s already plenty of pressing needs the county can spend the money on, without adding more.

“I believe that money would be best used for the purposes it’s already designated for — county roads and public transportation,” Lowen said. “When we have a functional bus system in West Hawaii, maybe I’d be willing to consider other uses, but, for now, there’s a lot of room for improvement in that area.”

Rep. Richard Onishi, D-Hilo, said the county had several opportunities to levy the GET surcharge over the past few years and declined to do so. Instead, he said, the county hiked gas taxes, weight fees and vehicle registration fees — fees he maintains hit the “local guys,” while up to 40 percent of the GET could be paid by tourists.

“I find a real contradiction with what they have done and what they are saying,” Onishi said. “They could have rolled back the other taxes and used the general excise tax.”

Onishi said bus service to his district, which runs from South Hilo to Ka‘u is “almost nonexistent,” making it difficult for children to participate in after-school activities.

The County Council last week approved a quarter-cent increase to the GET, bringing the county surcharge to one-half cent, estimated to add $50 million annually to the budget. Kim earlier this month submitted a $573.5 million preliminary proposed budget, a 10.7 percent increase. Because that was based on the quarter-cent GET surcharge, the amended budget due May 5 is expected to increase by another $25 million.

Of the current $25 million GET, $10 million will be transferred to the capital projects fund for roads; $9.5 million will be used for Mass Transit salary, wages and equipment; $5 million will pay principal and interest on old debts; $445,000 will go to employee retirement and post-retirement health accounts; $25,000 is allocated for workers comp and $25,000 for miscellaneous, according to the March 5 budget.