HONOLULU — Mormon critics are asking the U.S. Internal Revenue Service to investigate allegations that the church uses a Hawaii cultural center to commit tax fraud.

HONOLULU — Mormon critics are asking the U.S. Internal Revenue Service to investigate allegations that the church uses a Hawaii cultural center to commit tax fraud.

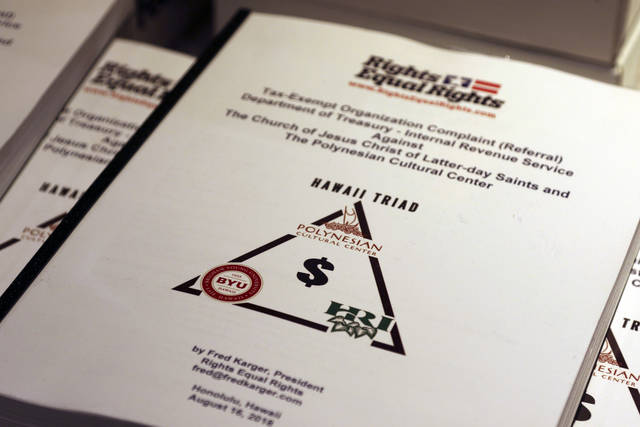

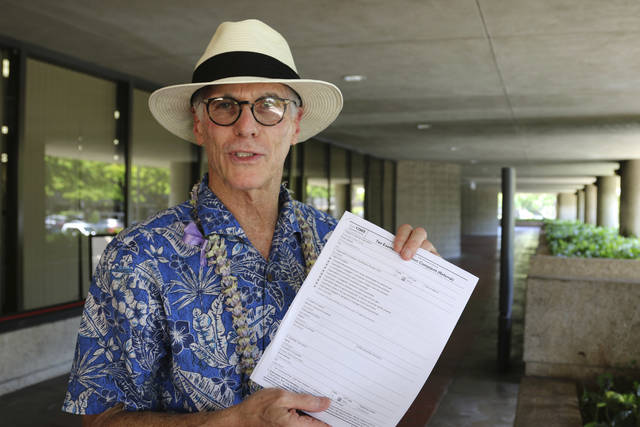

Gay-rights activist and Mormon critic Fred Karger delivered a complaint to a Honolulu IRS office Thursday asking for an investigation into possible tax abuses involving the Polynesian Cultural Center, Brigham Young University-Hawaii and a Hawaii land management company.

The complaint comes after Mormon critics aired television ads last year seeking information that could harm the church’s tax-exempt status.

A church spokesman declined to comment. An IRS spokeswoman says the agency doesn’t comment on taxpayer cases and doesn’t confirm whether there’s an investigation.

Karger says it’s unlikely the tax-exempt status will be revoked, but he hopes the attention forces changes. He’s also seeking investigations from other government agencies.

The Utah-based church has 16 million members worldwide, including 74,000 in Hawaii.

Subscribe today for unlimited access.

Already a subscriber?

Login

Not ready to subscribe?

Register for limited access.

If you have a print subscription but require digital access,

activate your account.

There should be no tax exemption whatsoever for any religious activity. This nation was built on the notion of separation of church and state.

True, however tax exemptions have been used to encourage non-profits (not just religious organizations) to do charitable work which may otherwise fall on the shoulders of the taxpayers. But this is not so for the PCC where charitable work takes a back seat to running a business centered around entertaining tourists and the general public – and also mixing in “missionary” and recruiting activities. It is a significant revenue generator and maybe there are some issues behind the scenes which warrant taking a closer look.

But PCC also employs a lot of people in the community, as does BYUH. The Church should continue to have tax-exempt status but not so PCC nor HRI, these 2 entities must pay their fair share.

Good points, a two-tier system does have merit.

Where would you draw the line, I bet almost every church and charity has something that smells fishy, maybe start with the Clinton Foundation…

Tax exemption status in the name of charitable intentions is troubling.

Not paying fair share of taxes through clever avoidance is almost unpatriotic as evasion is.

I agree that tax avoidance and evasion is unpatriotic. But our tax system currently is set up to encourage charitable giving, and many good (and some bad) organizations rely on these incentives to survive. So I expect that somewhere down the road we may see a “blended” solution to the abuses and other issues we currently have.