Consultants examine Hawaii County’s utility model

KAILUA-KONA — Hawaii is re-evaluating utility ownership models across the state, a process that began Monday with the first handful of words in what will be more than a year-long conversation between consultant groups and the public.

At the behest of the state Legislature, the Department of Business, Economic Development and Tourism has commissioned a study on the matter, enlisting London Economics International and Meister Consultants Group to run the show.

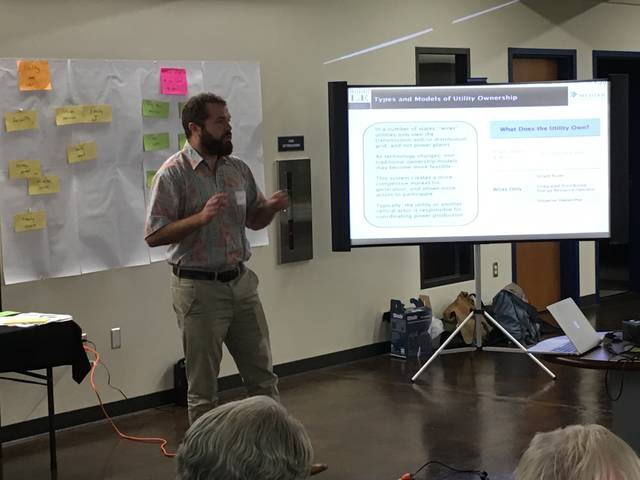

Consultants gave brief presentations before ceding the floor to community members Monday evening at the Hale Iako Building on the Natural Energy Laboratory of Hawaii Authority Research Campus in the first of a series of three meetings scheduled for the Big Island.

“I do want to emphasize that there is no overall best form of utility ownership,” said Ryan Cook, a senior consultant with Meister. “Different things are the right model for different places.”

The first question consultants posed was whether the public believes Hawaii Electric Light Co., an investor-owned utility, already is the most suitable model for Hawaii County’s needs or if a shift is desired.

County Councilman Tim Richards said making a cavalier statement on that without adequate research would be a mistake.

“I think the bigger question is we’d like our costs reduced, whatever that might mean,” Richards said. “High energy costs hamstring the economy. … By having more available dollars to be spent within our economy not going for energy but for something else, that makes a huge difference.”

Generally, those at the meeting expressed pleasure with HELCO’s reliability, online accessibility and timely repairs. They tended to agree with Richards about a desire for lower costs, adding they wanted more renewables incorporated into the grid and more innovation in the form of a smart grid and increased storage capacity to aid that transition.

There are three basic models of utilities. Investor-owned utilities, or IOUs, like HELCO are the most common, representing about 70 percent of models nationally.

Municipal utilities, also known as munis, are owned by the county or state governments and represent roughly 20 percent of models nationally. Finally, cooperative utilities, popularly referred to as co-ops, are customer-owned and represent 10 percent of models. Co-ops are often the choice of rural communities, however, and therefore cover roughly 70 percent of the country’s geographical area.

Depending on the model of utility, there are also sub-categories, such as a public-private partnership under the IOU model.

IOUs tend to have highly stable leadership and the best access to capital via private markets but are also for-profit companies with responsibilities to investors, as well as customers. Co-ops and munis have more limited capital access and more volatile leadership structures, but customers have greater control.

Co-ops also return profits directly to members, while profits in munis partially fund the governmental budget. Profits in IOUs go back to the private investors.

Kyle Datta, a general partner of the Ulupono Initiative and a Hawaii Island resident, said the most important factor missing from HELCO’s IOU structure is the alignment of priorities between the utility and its customers. He added that as long as HELCO’s endgame and its customers’ desires are at odds, there are going to be problems.

In Datta’s view, there are two solutions. The first is a co-op, which naturally aligns priorities as customers are also owners. The second is the current IOU model with the tweak of incentives to align the utility with those it serves. Such incentives would come in the form of regulations implemented by the Public Utilities Commission.

One such implementation Datta mentioned is a savings-sharing incentive, in which the utility gets a percentage of each customer’s savings. In other words, the more the ratepayer saves, the more the utility pockets. As it stands now, HELCO has little reason to incorporate renewables beyond governmental mandates because doing so reduces profits.

“What if the savings from going faster than the mandate would benefit the rate payers of Hawaii County and the utility?” he posed. “(HELCO) doesn’t make profits off renewables. But if they did, they’d be for them.”

Many of the utility’s circuits are at or near capacity for last generation solar energy. Next generation solar with on-site battery storage capable of exporting at night when demand for power increases significantly are, however, capable of supplying the grid with much more renewable energy.

Of course, shifting models and implementing a grid system more responsive to renewable energy sources — something attendees Monday night widely noted as one of HELCO’s primary deficiencies — costs money. Who pays for it is a question yet to be answered.

Another unanswered question tackled whether the county would qualify for rural investment funds from the federal government because without them, a co-op wouldn’t be feasible. Yet another question raised the issue of what to do about heavy HELCO investment in diesel power plants and how to make abandoning those assets financially acceptable.

Before filing a final report in early 2019, consultants will attempt to answer all these questions by starting with the two biggest: Who owns the utility, and what does the utility own?

As for any recommendation for transition to a new model and how that would work, Gabriel Roumy of London Economics said there’s no clear-cut answer. HELCO clearly wouldn’t be inclined to simply step away from a lucrative business.

“One of the things we’d be looking at if ever we decide on recommending a different ownership model … (is) the legal implications on how to transition.”