HILO — Renters and owners of second homes, especially those in West Hawaii, are about to feel the sting of changes the County Council made to Mayor Harry Kim’s proposed property tax hikes.

HILO — Renters and owners of second homes, especially those in West Hawaii, are about to feel the sting of changes the County Council made to Mayor Harry Kim’s proposed property tax hikes.

Those changes may not last long, however.

Kim said Thursday he plans to lower those rates at “the first opportunity we get to review.” That could be as early as next year, when the mayor and council again go through the annual budget-setting exercise.

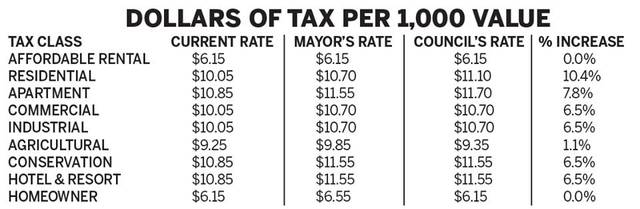

The mayor acknowledged that the council is well within its authority to change tax rates, but he said his across-the-board proposal was more fair for everyone. Kim had proposed raising rates 6.5 percent for all except the affordable rental class.

Adjustments made by the council in a late-night June 5 session hiked the residential class by $1.05 from the current $10.05 in property tax for every $1,000 in net assessed value. The council also raised the tax on apartment buildings, while reducing Kim’s proposals for taxes for homeowners and agriculture.

The changes added another $1.2 million in taxes to the three West Hawaii council districts from Kim’s proposal while reducing the other six districts by approximately $2 million, according to a West Hawaii Today analysis of the changes. Those numbers will change slightly when an estimated $3 million countywide in increases to the minimum tax are taken into account.

The council’s adjustments mean that North Kona’s District 8, with 11 percent of the population, will shoulder a full 33.4 percent of property taxes for the entire county, compared to 32.9 percent under Kim’s plan. At the other end of the scale, Puna’s District 5 will contribute just 3.9 percent, compared to 4.1 percent under Kim’s proposal.

“West Hawaii, especially District 8, is home to most of the resorts, high end luxury homes and second homes, so the increased rates in the hotel and residential classes are felt more here than in other districts,” said North Kona Councilwoman Karen Eoff.

Kim bristled at comments from some council members that the wealthy have more, so they should pay more.

“They already pay more. Substantially more,” Kim said. “It’s important that we don’t make them out to be the bad guy.”

He noted that nonresident homeowners don’t get the much lower base tax rates, nor do they get discounts from their assessed values for being a resident homeowner, with further exemptions based on age. And, in West Hawaii, their property is assessed higher, so they pay more based on that, he said.

Eoff was philosophical about the increases.

“The council did make changes to the proposal by the mayor, with the goal of not having to raise rates in the homeowners class, as well as to those in the agricultural class,” Eoff said. “This, I believe, was a way to help protect local families, people that live and work here and to encourage continued expansion of agriculture on our island.”

The residential class is composed of second homes for part-time residents, but it also includes rental houses, which is the bulk of the rental market in West Hawaii. While rentals also include short-term and vacation rentals, they also constitute a type of affordable housing for workers who can’t afford to buy homes.

Renters will feel the impact.

“The landlords pass this through,” said Puna Councilwoman Eileen O’Hara, who owns a rental house in Kona.

O’Hara, who along with Kona Councilman Dru Kanuha voted against the tax hikes, is proposing a task force be formed to establish new tax classes, including for short-term rentals and bed and breakfasts.

She said she voted against the tax increases because they were done without a clear policy rationale. A task force composed of the public and elected officials could also set a policy for raising taxes in the new classes, she said.

Kona Realtor Gretchen Osgood is also unhappy with the 10.4 percent increase in the tax on residential properties, the only class to take a double-digit percent increase. She said many officials think the class applies only to out-of-state owners who don’t vote. That’s not the case, she said.

The minimum tax of $100 will double to $200 for the least expensive properties. Some 31,651 parcels are affected, with the bulk of them — about 18,000 — in Puna’s two council districts.

The county Finance Department is currently working on applying the changes to the county’s 140,370 parcels, Lisa Miura, of the department’s Real Property Tax Division, said Thursday.

The tax rates are final and effective for the property tax bills that go out next month, with payments due Aug. 21.

Kim signed the $490.8 million operating budget June 9, a 6 percent increase compared with the current fiscal year. The budget goes into effect July 1.

About $16 million of the $37 million the tax hikes will generate comes from an increase in property values.