Flooding is an issue that literally hits people where they live.

Big changes are coming to Hawaii County’s flood zone maps following a multi-year effort by the U.S. Department of Homeland Security’s Federal Emergency Management Agency to update the maps to better reflect flood risk.

The maps are used to help set flood insurance rates as well as assist the government in making land use and development decisions.

It’s not known how many property owners will be affected. But changes in both West and East Hawaii could mean thousands of dollars in flood insurance for those who previously paid little or had no flood insurance at all.

“There are very serious financial decisions that people are going to have to make,” said Kailua-Kona Realtor Gretchen Lambeth.

Representatives from FEMA, along with the state Department of Land and Natural Resources and Hawaii County, have scheduled public hearings to answer questions, concerns, and provide information on the mapping timeline and appeals process.

A meeting will be held from 4:30 p.m. to 8 p.m. Monday at Aupuni Center in Hilo and from 4:30 p.m. to 8 p.m. Tuesday in Building G at the West Hawaii Civic Center in Kailua-Kona.

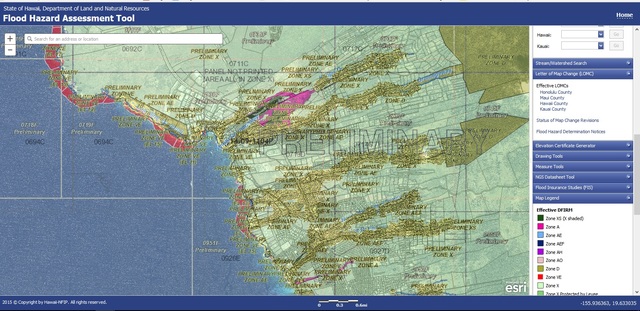

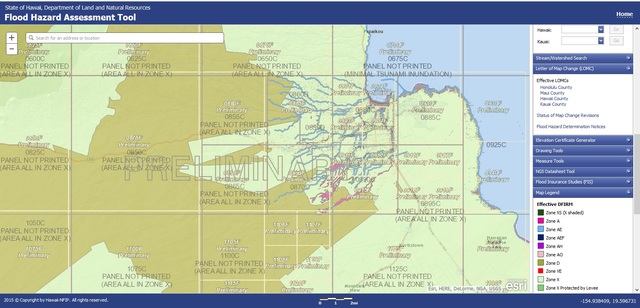

Maps will be available for viewing, and presentations will be held from 6 p.m. to 7 p.m. each evening. The public can also search the maps at https://gis.hawaiinfip.org/fhat

Officials expect a flood of questions about the maps.

Examples of affected areas in West Hawaii include the recently updated North Kona (Waiaha and Holualoa Drainageways) and South Kona Flood Hazard Studies, a spokesman for the county Department of Public Works said Friday. The preliminary maps include areas that are now not currently mapped such as a new Captain Cook Watercourse, and other flood-prone areas have been redefined.

In East Hawaii, the Waiakea Uka area near the intersection of Ainaola Drive and Haihai Street — an area that has flooded in the past, most notably in November 2000 — is being added to the map, as are many areas in Puna.

It’s a big deal for property owners, who will be required to add or increase their flood insurance coverage if they find themselves in a flood zone or in a higher risk flood zone. Properties can also lose value, if stricter development rules are imposed for construction in the area.

“Some areas where insurance was not required, people will be required to have insurance,” said Dan De Soto, an agent for Mutual Underwriters in Hilo. “If they already have flood insurance, they’ll be grandfathered in.”

Congress created the National Flood Insurance Program in 1968 to help provide a means for property owners to financially protect themselves. The NFIP offers flood insurance to homeowners, renters, and business owners if their community participates in the NFIP. Participating communities agree to adopt and enforce ordinances that meet or exceed FEMA requirements to reduce the risk of flooding.

“The federal insurance program doesn’t have enough money so the taxpayers had to foot the bill,” Lambeth said. “(But now) they’re actually going to start charging real rates for the insurance.”

She said the changes are happening across the United States as officials are systematically going over flood zones and moving the flood boundary lines out farther.

“It’s not just coastal property and tsunami zone property,” said Lambeth.

She said one area of note in West Hawaii are the dry riverbeds that run down Hualalai. Those riverbed boundaries have been widened, bringing more people into areas that will require flood insurance, she said.

Large swaths of Puna are also expected to see changes. Previously unmapped, there now will be flood zones delineated that could have serous financial implications for property owners.

“It was never really looked at before,” said Hilo Realtor Mary Begier, co-chairwoman for Hawaii Island Realtor’s Government Affairs committee. “In the Puna area, everything was sort of lumped into Zone X.”

Zone X is a low-risk zone determined to be outside the 500-year flood zone, where flood insurance is not required. Zones where flood insurance is required are high-risk zones beginning with the letter “A,” and coastal zones that have a 26 percent chance of flooding over the life of a 30-year mortgage, marked as “V.” Zones marked “D” are of undetermined risk, and flood insurance rates are commensurate with the uncertainty of the risk, according to FEMA.

Begier praised the federal, state and county officials who have been helping explain the changes to real estate and insurance professionals in advance of the public meetings.

“We’ve been encouraging all our clients to go down and see where their property is on the flood maps,” she said.

Hilo Realtor Jan Mahuna agrees that the county’s flood maps have been lacking. She’s still not convinced the latest re-do will fix them.

“The maps have been incorrect from the get-go,” Mahuna said. “From the very beginning, no in-depth study was done by the county. … It’s still not an accurate account of who should get flood insurance and who shouldn’t.”

After the public hearings, citizens, elected officials and staff have the opportunity to review the preliminary flood maps thoroughly. The review period provides local officials and citizens with an opportunity to correct or add to the nontechnical information presented on the preliminary maps. Tentatively, the Flood Insurance Rate Maps are planned be effective in the spring of 2017 for flood insurance purposes.