Big Island taxpayers might not have been reimbursed for three of the 164 purchasing card charges an auditor identified as not following Hawaii County’s own policies or possibly violating state law. ADVERTISING Big Island taxpayers might not have been reimbursed

Big Island taxpayers might not have been reimbursed for three of the 164 purchasing card charges an auditor identified as not following Hawaii County’s own policies or possibly violating state law.

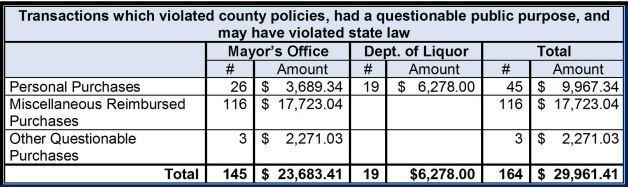

The report, which mostly identified abuse in the Mayor’s Office, found $29,961.41 in charges either considered personal, questionable or lacking proper documentation since 2009.

County Legislative Auditor Bonnie Nims said pCard users reimbursed the county for 161 of those charges totaling $27,690.38, though not always in a timely manner.

The report made no mention of the remaining three charges, each listed as questionable, being paid back, and a review of pCard records obtained by the Hawaii Tribune-Herald through a records request found no matching reimbursements.

Those charges totaled $2,271.03 and were made by Mayor Billy Kenoi’s executive assistants.

Phone calls and emails left with his office over the past week seeking comment on the transactions and the report were not returned.

The questionable transactions included airfare for a Big Island teenager who was competing in a California surfing event ($1,270.60), a helicopter ride for a U.S. Conference of Mayors affiliate and their family ($652.40), and wine for state lawmakers ($348.03).

The newspaper identified the charges in an earlier report examining pCard use by Kenoi’s aides.

Nims found several issues with the transactions.

Airfare

The Mayor’s Office said it paid for Kalapana surfer Jimmy Napeahi’s airfare to the Surfing America USA Championship in 2012 because he was a “youth ambassador” representing the island.

But Nims said the office “could not demonstrate how the youth ambassador was selected or that there was any official recognition upon return.”

Napeahi, who is from the same hometown as Kenoi, told the Hawaii Tribune-Herald he asked the mayor for a sponsorship to help him get to the event. He was 15 at the time.

Nims said the plane ticket was purchased one day before the trip through a “web-based airline ticket provider” and that the office couldn’t demonstrate it sought three written quotes required for airfare greater than $1,000.

Additionally, she said such an expenditure would require a “request for adjustment and exceptions form” from the county’s finance director. The form would allow the council chairperson to review and disallow the transaction.

No such form was obtained.

Helicopter ride

The same form was required when paying for a helicopter tour for the U.S. Conference of Mayors representative and family members in July 2014, Nims said. Again, the Mayor’s Office didn’t request the form.

“While a county benefit may be derived from providing this ride to an affiliate of the USCM, the benefit of the cost of the family, as well as public perception from a reasonable person standpoint, is questionable,” she said in the audit.

Wine

County records show one of Kenoi’s aides purchased 25 bottles of wine April 23, 2014, at Tamura’s Fine Wine store in Honolulu, the same week the mayor was visiting with lawmakers to seek a greater share of the transient accommodation tax for Neighbor Islands.

Someone wrote on the receipt that the wine was “omiyage for legislators.”

The county’s pCard policy prohibits alcohol purchases unless “specifically authorized.”

“It is unclear what type of authorization was required or obtained in this situation,” Nims said.

She said the state’s pCard policy treats alcohol as a prohibited item even if that’s not explicitly stated.

“We believe the state guidelines are a sound point of reference and we question whether these items have a clear public purpose or benefit,” Nims said.

The state’s ethics code doesn’t prohibit lawmakers from receiving alcohol, said Les Kondo, state Ethics Commission executive director.

The code does prohibit gifts intended to influence lawmakers, though the Ethics Commission has provided an exception for meals under $25, he said. The wine bottles might be considered a nominal gift and included in the same exemption, since they didn’t exceed $18, Kondo said.

Email Tom Callis at tcallis@hawaiitribune-herald.com.