The Big Squeeze, Part 1: Five county taxes and fees are increasing

HILO — Big Island residents are feeling the squeeze from recent hikes in taxes and fees. And there are more in the works.

HILO — Big Island residents are feeling the squeeze from recent hikes in taxes and fees. And there are more in the works.

Mayor Harry Kim’s administration, with the concurrence of the County Council, has recently raised, or is in the process of raising, five different taxes and fees. The state, meanwhile, has initiated its own set of increases. And utilities and the private sector aren’t far behind.

“Christmas is a time for giving. I give to the state, give to the county, gave for pay raises, gave for gas, gave for property tax, gave for boat ramp and docking raises and so forth and so on and we will be giving more soon,” said Keaau resident Damon Castor. “Living in this state is like a frog in a pot over a fire. You are getting taxed to death and are not realizing it until it’s too late.”

Castor said he moved to the island from Ohio on his retirement because he saw high taxes forcing businesses in his small town to shutter their doors and he didn’t want to live in a dying neighborhood. He’s since taken a part-time job to supplement his pension.

“It’s a money grab; that’s all it is,” Castor said of the recent tax increases. “A money grab.”

It’s too early in the county budget process to know if more increases will be sought next year, Kim said. County departments were proposing budgets to the administration last week, and property values have yet to be determined.

Faced with expenses outside county control, such as salaries negotiated at the state level, federal mandates for infrastructure such as replacing cesspools and an increased need for services like police, it’s difficult to balance the bottom line, he said.

Kim said he’s asked departments to present budgets with no increases in costs or employees, as the administration works to come up with a budget to present to the council next spring.

“Everybody understands the problem of raising taxes,” Kim said, “but everybody needs to make a choice — where do we want to go. (The public) is asking for things that we don’t have.”

Breaking down the costs

If each man, woman and child living on the island dug into a pocket and handed over his or her share of the cost of running county government, that amount would be $2,615.

Those on the receiving end call it the per capita operating budget, while those on the giving end may call it the local tax burden. It’s computed by dividing the total operating budget by the number of residents.

County officials say the $2,615 the average person spends on county government brings a lot of benefits: roads, parks, public safety, sanitation and the like. The number is one of the lowest, if not the lowest, averages in the state, they add.

Since 2000, Hawaii County’s population has risen by 34.7 percent. The number of county employees has increased by 27.6 percent. But during that time, the county budget, adjusted for inflation, has more than doubled.

In 2000, there were 2,053 county employees servicing a population of 148,677 at a cost of $175.8 million, or $249.4 million in 2017 dollars, according to a recent West Hawaii Today analysis of census data, county budgets and financial audits.

Today, there are an estimated 200,381 residents being served by 2,479 employees, with a price tag of $524 million.

Kim said he realized his administration has asked the council to raise taxes and fees a lot lately. Unfortunately, he said, many programs have been neglected over the past years, and improvements are needed.

“In reviewing this, it seems like in this very short time, we’ve been coming to the County Council so many times for either a tax increase or a rate increase,” Kim said, adding that the council has to “play a little catch-up,” because necessary increases had been put off.

The recent increases came even before county coffers were stressed by natural disasters this year.

Finance Director Deanna Sako said the county’s current budget challenges can’t all be attributed to the natural disasters. Most of the increases come from the cost of employees and retirees, for wages set at the state level and pensions and other post-employment benefits set by state law.

“A lot of these things that have gone up are not under our control or our sole discretion,” Sako said. “But if I call 911, I want the police to come. I want firefighters to come. A lot of our services are very labor intensive.”

Increases on the horizon

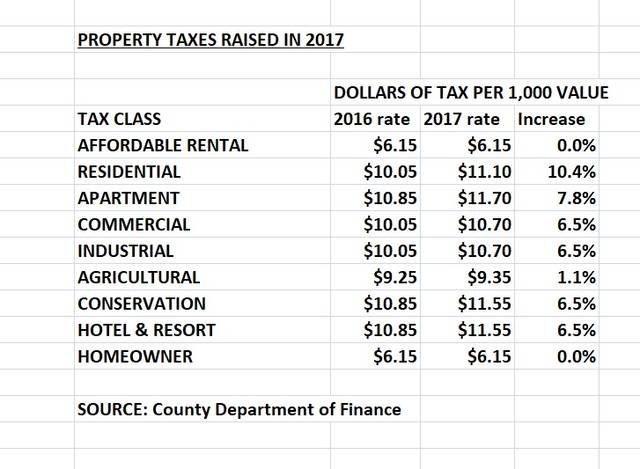

The County Council in 2017 raised property taxes, the county government’s largest revenue source, even more than recommended by the Kim administration for some classes. While the council held homeowners at the same rate as the previous year, second homes and rentals took a 10.4 percent increase and apartments saw a 7.8 percent increase. Kim had recommended a 6 percent increase across the board.

Property values went up about 4 percent, meaning even those whose rate didn’t go up paid more taxes.

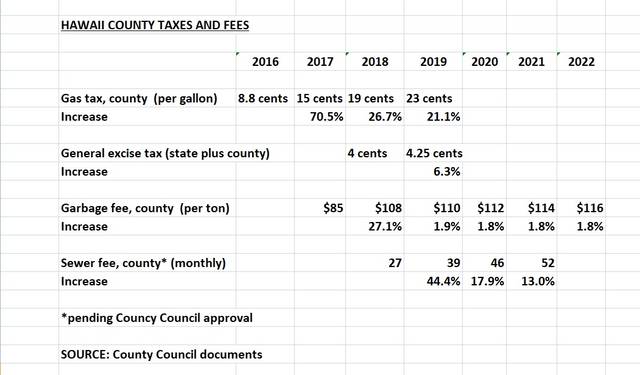

The cost of retail goods and services is set to increase Jan. 1, when a county quarter-cent surcharge on the state general excise tax begins to be collected. That means the total state and county tax will go up from 4 percent to 4.25 percent, a 6.3 percent increase in the tax.

“The unfortunate reality of the situation is, it costs money to provide services for the community,” said Council Chairman Aaron Chung. “As much as we try to advocate for a prudent spending policy, things cost money.”

Local Realtor Mary Begier, who lobbied against the GET surcharge because she doubted the money would go to roads, said the administration’s recent requests to the state Legislature to allow the county to use the tax for other purposes only justifies her concerns.

“There’s never going to be enough money if the government is going to be everybody’s mother,” Begier said.

The county’s portion of fuel taxes, meanwhile, which went up an eye-popping 70.5 percent in 2017, increased another 26.7 percent in 2018 and will go up another 21.1 percent March 1, unless the County Council takes action to stop it. The tax, which was 8.8 cents a gallon, is now 19 cents and will automatically go up to 23 cents next year.

Kohala Councilman Tim Richards plans to try again to slow the gas tax increase, after being unsuccessful so far.

“Considering all the new damage our county has dealt with because of Hurricane Lane and the lava event, I believe it is important not to reduce any funding but also, just as important, not increase any more taxes,” Richards said.

Disaster help, but more hikes loom

Gov. David Ige’s administration has so far kicked in $22 million for recovery from the May 3 eruption, and the federal government reimburses the county for 70 percent of most response and recovery costs. But more county money will be needed, in addition to compensating for the approximately $4 million in taxes lost from inundated property.

And then there are fees, as the county makes up for garbage and sewer fees that haven’t been raised in at least a decade.

“We have been the recipients of having to do things that should have been done 10 to 15 years ago,” said South Kona/Ka‘u Councilwoman Maile David, chairwoman of the Finance Committee.

The price rubbish haulers pay at the county’s Hilo and West Hawaii landfills went up in 2018 to $108 a ton, a 27.1 percent increase, with annual increases to continue until the price reaches $116 in 2022.

The increases most affect commercial customers, such as those with dumpsters like condominium dwellers, retail shops, grocery stores and other businesses. Small haulers who pick garbage up curbside for residential customers will see a residential credit increase that should wipe out the tipping fee hike, officials said.

Hawaii County residents and visitors are able to dump their trash for free at county transfer stations.

An increase in sewer fees is also in the works. After unanimous approval from a council committee, the proposal was cleared by the Environmental Management Commission and now returns to the council for two final votes.

The current $27 monthly fee would increase to $39 March 1, if approved by the council in time. That’s a 44.4 percent increase. Increases would continue annually until the monthly charge reaches $52 in 2021.

Richards wants a more holistic approach to budgeting, rather than what he views as the current piecemeal approach. He’s hoping the council next year will look at all revenue streams and costs at the same time.

“People want value and we have to set that value,” Richards said. “I want to look at things in context.”

Well, yeah, but Hawaii residents don’t mind paying those taxes, because the money goes to such good use, the various government agencies don’t waste anything or fail to account for it. Oh . . . wait . . .

By the way, any time Richards or Eoff are quoted there should be a footnote that they don’t always tell the truth. Richards for example signed a false financial disclosure form that left off a significant source of vacation rental income at the same time the council was working on new law.

Eoff and Richards rarely ever tell the truth. Eoff da Tax Whore!

Taxes, increasing homeless problems, too much regulation and poor medical services were foremost in our decision to leave the island after living there for almost 34 years. Now living in Texas which has great medical, no state income tax, extremely low cost of living (gas, food, etc.) and competent officials on the state and local levels. Have not looked back and do not regret our decision to leave.

Waiting for government employee union contracts to come up and there will be another BIG tax raise with little if any benefit

Hey!

They the Hawaii goberment is doing sooooo well

….give them a raise!

You have water, right?

The leeches, loafers, and druggies are left alone, esp at OldA, right?

The roads are smooth and level with you money, right?

etc, etc,etc

Oh, in normal business these jokers would be fired

…but this is goberment, so they deserve big, fat raises

…..and YOU must pay!!

Haaa, Haaa, Haaa!

Welcome to Hawaii…the first socialist experiment in the US. But can we get to the status of Venezuela? Yes we can! They will chase out anybody that actually produces…just hang in!

These Legal Mafia members we continue to elect just Tax and Spend, Tax and Spend.

Every man, woman, and child must pay $2700.00 a year to pay for their spending spree. Unfortunately, children don’t pay taxes, a third of the population is on government

support, so who is left to pay all the taxes? You guessed it, the worker bees in the middle.

Way to go Harry, that’s the way to restore trust in government. But look on the bright side, he and his pals will be laughing all the way to the bank.

I suggest we go to the politicians homes and their relatives homes protest. When they are out in public let them know they are not welcome out in public. make their lives, their families lives, their children’s lives and any of their friends a living hell! It’s the Democrat way!

You can tax a state into prosperity said no one ever.

TAXATION IS THEFT