HONOLULU — Gov. David Ige lent his political weight Monday night to a proposed constitutional amendment that would allow the state to tax investment properties to support public education, while also promising to veto any resulting bill that might raise property taxes for owner-occupied homes or increase rents on affordable housing.

The governor also pledged to oppose using property taxes to replace general funds for education.

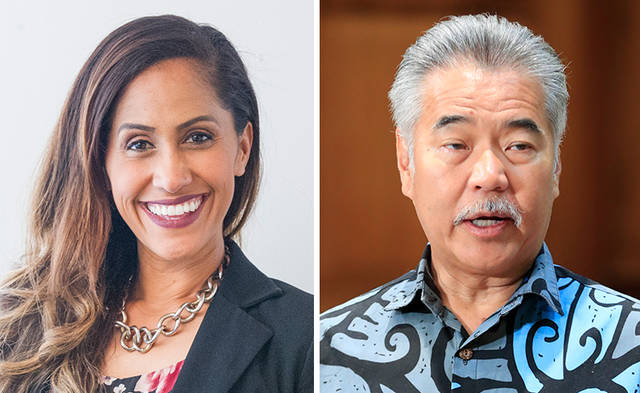

Ige’s statements during a KHON gubernatorial debate with his Republican opponent, state Rep. Andria Tupola, might help boost public support for the ballot measure, but it still faces stiff resistance from all four counties, a well-funded coalition of business interests and four former Hawaii governors. Tupola also opposes the measure.

The issue will ultimately be decided by voters in the Nov. 6 election.

“I support this amendment because we’ve seen year after year about the needs of our public education system that cannot be funded with the funds that we have,” Ige said. “You know, Hawaii is the only state in the country where zero dollars — not a single penny of property taxes — goes to our public schools.”

Most of the nation’s schools are funded by local property taxes. By contrast, Hawaii has a statewide public education system that is funded primarily by state general funds. The Hawaii State Teachers Association, the biggest backer of the ballot measure, has argued that past attempts to raise revenue for schools from other sources have failed. The union is advocating for a tax on second homes valued at more than $1 million to boost teachers’ salaries and better fund classrooms.

Hawaii has the lowest property tax rates in the country, and the union has argued this incentivizes outside investors to purchase homes, driving up the overall cost of housing for local residents.

The ballot measure has been met with an avalanche of criticism from county governments and a coalition of businesses called the Affordable Hawaii Coalition. The coalition has warned that giving the state the power to tax property, which currently only the counties have, would increase the cost of living in Hawaii, affecting businesses, property owners, renters, consumers and farmers. They’ve also warned that there is no guarantee that extra revenue would go to teachers’ salaries and classrooms.

Ige, who won the HSTA’s endorsement during the primary election, sought to quell public concerns over the ballot measure during the gubernatorial debate.

“If I have the privilege of serving as governor another term, I guarantee you that I would veto any measure that increased the property taxes for residents, that does not guarantee that any revenue generated from this property tax would be in addition to what’s there” and that didn’t guarantee the money would “go to teachers, students and the classroom,” said Ige. “And finally, we will make sure that none of the taxes get increased on affordable rentals. You know, we clearly are focused on creating affordable rentals, and so certainly all of the concerns raised by those advocating a ‘no,’ I guarantee you, will not occur if I am governor.”

The HSTA said after the debate that Ige’s comments disproved the “misleading scare tactics being spread by opponents.”

If voters pass the ballot measure, it will then fall to the state Legislature to propose and debate any new property taxes.

The political fight over the measure is intensifying with early mail-in ballots going out this week ahead of Election Day. The Affordable Hawaii Coalition, which has raised hundreds of thousands of dollars to defeat the ballot measure, launched a new commercial this week featuring four of Hawaii’s former governors: Neil Abercrombie, John Waihee, Ben Cayetano and George Ariyoshi.

“You know, if you’re a renter you’re going to get smashed,” Abercrombie tells Waihee in a mock conference call. “In fact, everybody’s going to get hurt.”

“It’s a blank check for raising taxes,” Cayetano says.

“You’re going to be taxed twice — once by the city and once by the state,” Abercrombie retorted.

Sure he does they always want more of our money. It is bait and switch oh it will be for education but no it will not.

How many tax raises has there been this year already three at least enough enough of Ige too

Of course Ige supports higher taxes. He was endorsed by the HSTA and is beholden to their requests. No surprise here.

The rail is going to cost 12 billion dollars when it is complete and is going to be a heavy ongoing maintenance burden.

There are only 200,000 students here in Hawaii. Cancel the rail and you have an additional $60,000 per student + annual maintenance. This is a no braiiner! Use the new TAT tax to fund education.

I just can’t believe the massive tax increases we have seen in just the last two years.

Tax, tax, tax, tax and add another tax! That is all Ige and he crones statewide know. Wake up Hawaii!

And all this time I thought my taxes went to pay for education already.

Tax and Spend, Tax and Spend.

I was going to vote for Ige, guess my vote will have to find a new home.

. Andria Tupolae is our only hope..

Of course he does, Just Say No to Ige and his robbers. WALK AWAY

I just moved here 7 months ago. I was delighted to buy a house and see that my property taxes are 1/10th of what they were on the mainland. Then I saw the sorry state of school buildings here. I heard teachers are leaving in droves. Is Hawaii going to always be 50th, last in education? Are kids going to just stay here after graduation? Why would they? Where is their support and funding coming from? Legit questions… I really want to know.

We have a state run education system, not county. Funding comes from state general funds pulled through an incredibly regressive excise tax . Excise, unlike sales tax, applies to everything you buy, including staple grocery items. It also applies to every level of the sales cycle. So while a sales tax is paid once by the end consumer an excise tax is paid by the distributor and the wholesaler and the retailer and the end consumer. By the time you buy something at the store it has already been taxed 2 or 4 times. So the price you pay already includes 10 to 20% tax and then you pay tax on top of that. Additionally, with an excise tax it is on everything. Not just goods but also services. So you will see that your landscaper charges you as does your plumber, electric company, etc. The 2nd source of funding is from the state income tax. The end result is that Hawaii already has the 2nd highest tax burden in the country and it targets the most needy, since survival items are taxed like bread and milk. This new tax will again target the poor as anyone with a long term rental will have a new tax, which of course will be passed on to the renter.

Michael, thank you so much for explaining this to me. I really appreciate it. Sounds like an overhaul is needed badly here. I thought the schools were bad in Seattle but then I saw the schools (here on the BI). I would hope the citizens and government would strive to get teachers better pay and students proud when they go to school, and know they can get high paying jobs, so they can stay in the land that they love.

In Seattle, our property taxes were increasing yearly (and dramatically) for mostly education and the homeless. Increasing property taxes, to me is not very creative. Sin taxes might be the way to go here. Booze, cigarettes, pot. Could put millions directly into the schools, and possibly bring down prices on all the services and goods you mentioned. Again, mahalo for informing me on this.

The teachers union is flat out lying. “The union is advocating for a tax on second homes valued at more than $1 million to boost teachers’ salaries and better fund classrooms.” THIS APPLIES TO ALL INVESTMENT PROPERTY. THERE IS NOTHING IN THE CONAM ABOUT MILLION DOLLAR PROPERTIES. JUST READ IT. THERE IS NOTHING ABOUT TEACHERS SALARIES. JUST READ IT. THERE IS NO CAP. JUST READ IT. The teachers won’t see a dime, they are being played