HILO — If each man, woman and child living on the Big Island dug into a pocket and handed over his or her share of the cost of running county government, that amount would be $2,449.

Those on the receiving end call it the per capita operating budget, while those on the giving end may call it the local tax burden. It’s computed by dividing the total operating budget by the number of residents.

Whatever you call it, the public’s share of government in Hawaii County is the lowest in the state, administrators told the County Council on Tuesday, as they kicked off three days of department-by-department budget reviews for the fiscal year that starts July 1.

In comparison, Maui’s per capita operating budget is $3,395; Kauai’s is $2,793 and the City and County of Honolulu’s is $2,478, said Finance Director Deanna Sako.

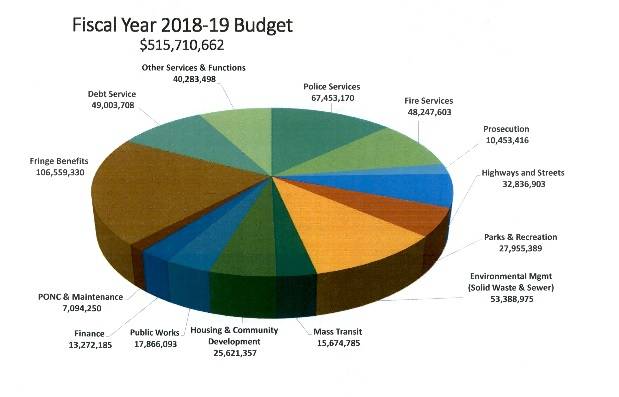

The county’s proposed $515.7 million operating budget is a 5.1 percent increase over this year. That may change, however, once Mayor Harry Kim releases his final proposed budget May 5.

“What will come forth no one knows,” Kim said. “In the event any additional revenues come forth to us … we’ll come to you with a revised budget.”

Still up in the air among potential revenue sources is how much the county will get of the transient accommodations tax, commonly called the hotel tax, that is collected on Big Island short-term rentals. The amount is currently capped at $19.3 million, but the state Legislature may give the county more before it recesses May 3.

“The state kept that during the recession and never gave it back,” Sako said. “Our departments have cut and trimmed wherever we can. … We’re doing the best we can with the hand that was dealt to us.”

The Legislature may also allow the County Council to tack on a half-cent surcharge to the state general excise tax, which could add $50 million to the budget. Kim has been pushing this as a revenue source, but the council has been less enthusiastic.

Since 2000, Hawaii County’s population has risen by 33.5 percent. The number of county employees has increased by 27.6 percent. But during that time, the county budget, adjusted for inflation, has doubled.

In 2000, there were 2,053 county employees servicing a population of 148,677 at a cost of $175.8 million, or $249.4 million in 2017 dollars, according to a West Hawaii Today analysis of census data, county budgets and financial audits.

Today, there are an estimated 198,449 residents being served by 2,479 employees, with a price tag of $491 million.

Because of reduced revenues from other sources, property taxes now account for 75 percent of the county’s general fund, compared to about 60 percent a decade ago. Salary, wages and benefits for employees, accounting for about 50 percent of the budget 10 years ago, is now up to 62.7 percent of the budget.

Meanwhile, the county’s budget buffer has eroded. The county charter recommends between 5 percent and 15 percent of general fund expenditures be socked away into either the budget stabilization fund or the fund balance. That figure is now at 5.2 percent.

This doesn’t look like Kansas!

and it must be real hard to “kick back” on the beach with the

cushy salary, cushy pension, cushy medical, cushy, cushy, cushy,

….and the stress! The need (another) raise!

$2,449 is just for the county then you have the state and the feds which cost a lot more per person than the county. Once the government gets their “fair share” there is just not much left and that my friends is by design because it keeps people needing the government.

Another point is that fringe benefits, debt service, and finance fees are mostly pensions and benefits and are a whooping 32% of the county budget. This way once these guys fleece us then they can go on to a very wealthy retirement and benefit package that oh BTW is not even taxed in Hawaii (Government pensions are the one thing that is not taxed in Hawaii).